Apple Pay

Intro

Apple Pay is Apple’s mobile payment product, which allows consumers an easy and secure way to pay for physical goods and services such as groceries, clothing, tickets and reservations in your iOS apps. By using Touch ID, users can quickly and securely provide their payment.

The customers add their credit or debit cards to their wallet on their iPhone and adds the payment and shipping information to the Apple Pay wallet. The payment details the consumer enters in the Apple Pay wallet are tokenized and then securely stored. If the consumer clicks the “Buy with Apple Pay” button in the app, the payment can immediately start, since the card with which the consumers wants to pay will be loaded from the Apple Pay wallet.

Our iOS SDK allows you to easily add Apple Pay to your mobile app. We will manage the decryption of the payment data for you. If you want to, you can also choose to decrypt the data yourself and send it over to us to process the payment.

Your customers can use cards from the following brands:

Apple Pay - Visa

Apple Pay - MasterCard

Apple Pay - American Express

Key benefits

- A frictionless consumer experience using Apple’s native Touch ID

- Easy integration for developers using our iOS SDK

- A secure way of paying as the card data of the consumer is tokenized and the Device PAN (DPAN) is used to process the payment.

- Increase your conversion for in-app payments

- Huge potential in terms of usage, due to the millions of users on iOS devices.

Payment experience

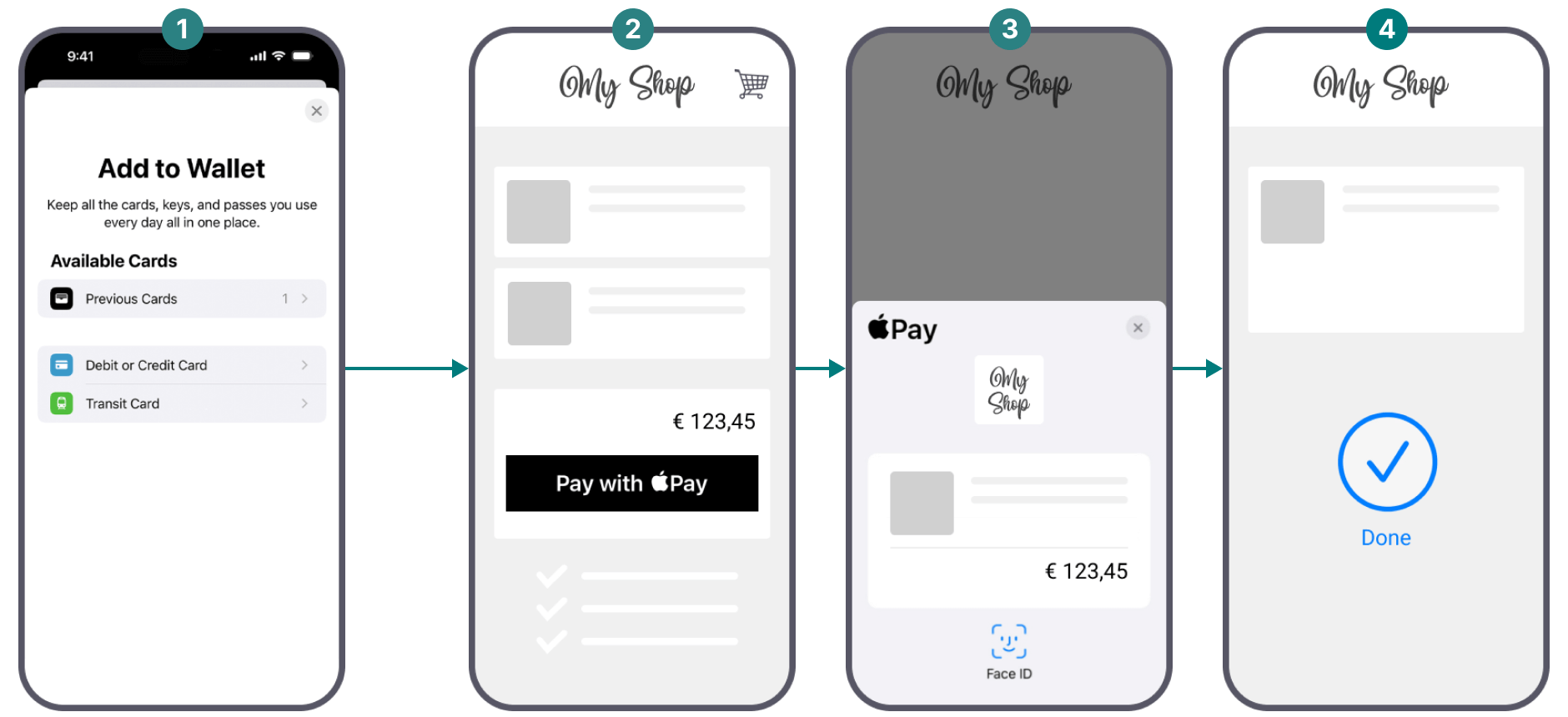

-

In countries in which Apple Pay is supported, the option to add a card to the wallet on the device of the consumer will be enabled. The consumer can add her/his payment details as well as shipping and billing address in the app.

-

Within an app that supports Apple Pay, the button “Buy with Apple Pay” will appear when the consumer is ready to checkout.

-

The card details of the consumer are visible and can be changed upon wish of the consumer. Next to that the total amount is also displayed. The consumer will need to use Touch ID to validate the payment.

-

Once the payment is validated it will be sent via the typical purchase flow, so that we can process this payment.

Onboarding

To accept payments for this payment method, make sure you

- Have an acquisition contract with one of the supported acquirers. We will clarify this with you during the onboarding process

- Accept Apple's terms and conditions as described in the dedicated chapter. This will allow you to register your Apple Merchant ID and to offer Apple Pay on our secure payment page

Countries & currencies

Supported countries

-

Australia

Australia

-

Belgium

Belgium

-

Brazil

Brazil

-

Bulgaria

Bulgaria

-

Canada

Canada

-

China

China

-

Croatia

Croatia

-

Cyprus

Cyprus

-

Czech Republic

Czech Republic

-

Denmark

Denmark

-

Estonia

Estonia

-

Finland

Finland

Supported currencies

- Albanian lek (ALL)

- Algerian dinar (DZD)

- Angolan kwanza (AOA)

- Argentine peso (ARS)

- Armenian dram (AMD)

- Aruban florin (AWG)

- Australian dollar (AUD)

- Azerbaijani manat (AZN)

- Bahamian dollar (BSD)

- Bahraini dinar (BHD)

- Bangladeshi taka (BDT)

- Barbados dollar (BBD)

Integration

To make this payment method appear on our Hosted Checkout Page as a selectable payment method, your customers need to:

- Be located in one of the supported countries.

- Own at least one of the supported cards in their Apple Pay wallet:

Apple Pay - Visa

Apple Pay - MasterCard

Apple Pay - American Express

. - Browse with Safari.

- Use one of the following devices:

iPhones with Face ID and/or Touch ID (except iPhones 5S).

iPad Pro, iPad Air, iPad, and iPad mini models with Touch ID or Face ID.

Apple Watch Series 1 and 2 and later, Apple Watch (1st generation).

Mac models with Touch ID, or Mac models introduced in 2012 or later with an Apple Pay-enabled iPhone or Apple Watch.

Make also sure to register your Merchant ID as described in the dedicated chapter.

Redirect your customers to the Apple Pay payment sheet via our Hosted Checkout Page. Find a high level overview in the "Process flows" chapter.

Hosted Checkout Page

Add the following properties to a standard CreateHostedCheckout request:

{

"order":{

"amountOfMoney":{

"currencyCode":"EUR",

"amount":1000

}

},

"hostedCheckoutSpecificInput":{

"locale":"en_GB",

"returnUrl":"https://yourReturnUrl.com"

},

"mobilePaymentMethodSpecificInput":{

"authorizationMode":"FINAL_AUTHORIZATION",

"paymentProductId":302

}

}| Properties | Remarks |

|---|---|

|

order.amountOfMoney |

amount: The gross amount you want to charge for this order. |

|

hostedCheckoutSpecificInput |

locale: The language version of our Hosted Checkout Page and the Apple Pay payment sheet. returnUrl: The URL we redirect your customers to after the payment has been finalised. |

|

mobilePaymentMethodSpecificInput |

authorizationMode: Set to either "FINAL_AUTHORIZATION"/"SALE" depending on whether you want to process payments in authorisation/direct sale mode. paymentProductId: The numeric identifier of the payment method on our platform. Find this id in the "Overview" chapter. It instructs our platform to send your customers directly to the Apple Pay payment sheet. If omitted, our platform sends your customers to the Hosted Checkout Page instead, allowing them to choose this or any other payment method that is active in your account. |

Find detailed information about this object and its properties in our CreateHostedCheckoutAPI.

Find detailed information about this object and its properties in our CreatePaymentAPI.

Find detailed information about this object and its properties in our CreatePaymentAPI.

Process flows

Depending on your customers' device(s) used, differences apply:

With an Apple device

- Your customers finalise an order on their Apple device in your shop and select Apple Pay.

- You send this CreateHostedCheckout request to our platform.

- You redirect your customers via the redirectUrl to our Hosted Checkout Page.

- Your customers click on the "Apple Pay" button on the Hosted Checkout Page. The Hosted Checkout Page opens the payment sheet.

- The Apple device opens the Apple Pay app. Your customers confirm the payment in the app.

- We receive the transaction result.

- We redirect your customers to your returnURL on their Apple device.

- You request the transaction result from our platform via GetHostedCheckout or receive the result via webhooks.

- If the transaction was successful, you can deliver the goods/services.

With a desktop and a mobile device

This flow involves both your customers' mobile/tablet and desktop device interacting with each other. The mobile/tablet device must be an Apple device, but the desktop device can be from any brand.

- Your customers finalise an order on their desktop device in your shop and select Apple Pay.

- You send this CreateHostedCheckout request to our platform.

- You redirect your customers on their desktop device via the redirectUrl to our Hosted Checkout Page.

- Your customers click on the "Apple Pay" button on the Hosted Checkout Page. A QR code is displayed. Your customers scan the displayed QR code with their mobile/tablet Apple device.

- The mobile/tablet Apple device opens the Apple Pay app. Your customers confirm the payment in the app.

- We receive the transaction result.

- We redirect your customers to your returnURL on their desktop device.

- You request the transaction result from our platform via GetHostedCheckout or receive the result via webhooks.

- If the transaction was successful, you can deliver the goods/services.

Testing

Refer to our Test cases for test data and detailed instructions.

- Make sure to use the right endpoint and switch back to the live URL as soon as you have finished your tests.

- The data in our Test cases ONLY work for payment requests in our test environment. Using this data in our production environment will lead to undesirable testing results.

Additional information

Apple Pay and Card On File

Card On File (COF) allows a customer's card details to be stored for future payments, which is also possible for Apple Pay.

The COF framework defines the fair use of stored card data, giving you specific instructions. We explain these in the dedicated use cases section and provide for each JSON samples/API endpoints. Apple Pay only supports use case A and E and as differences apply, we document them here directly.

Sample A - CIT first & recurring

| CreateHostedCheckout | CreatePayment |

|---|---|

|

|

Apple Pay Recurring Payment Request

For CreatedHostedCheckout the applePayRecurringPaymentRequest object is required in paymentProduct302SpecificInput. Everything defined under the applePayRecurringPaymentRequest object is used to configure the Apple Pay payment sheet on the customer device. The information is only for visual purposes and will not be used for the payment processing.

Recurring with immediate start and no end date:

{

"mobilePaymentMethodSpecificInput": {

"paymentProduct302SpecificInput": {

"recurring": {

"recurringPaymentSequenceIndicator": "first"

},

"applePayRecurringPaymentRequest": {

"paymentDescription": "Test subscription",

"regularBilling": {

"label": "Subscription",

"amount": "20.00",

"type": "final",

"paymentTiming": "recurring",

"recurringPaymentIntervalUnit": "month",

"recurringPaymentIntervalCount": 1

},

"managementURL": "https://worldline.com"

}

}

},

"hostedCheckoutSpecificInput": {

"isRecurring": true

},

"order": {

"amountOfMoney": {

"amount": 10,

"currencyCode": "EUR"

}

}

}

Recurring with specific start date and no end date:

{

"mobilePaymentMethodSpecificInput": {

"paymentProduct302SpecificInput": {

"recurring": {

"recurringPaymentSequenceIndicator": "first"

},

"applePayRecurringPaymentRequest": {

"paymentDescription": "Test subscription",

"regularBilling": {

"label": "Subscription",

"amount": "20.00",

"type": "final",

"paymentTiming": "recurring",

"recurringPaymentStartDate": "2025-01-07T00:00:00",

"recurringPaymentIntervalUnit": "month",

"recurringPaymentIntervalCount": 1

},

"managementURL": "https://worldline.com"

}

}

},

"hostedCheckoutSpecificInput": {

"isRecurring": true

},

"order": {

"amountOfMoney": {

"amount": 10,

"currencyCode": "EUR"

}

}

}

Recurring with specific start date and specific end date:

{

"mobilePaymentMethodSpecificInput": {

"paymentProduct302SpecificInput": {

"recurring": {

"recurringPaymentSequenceIndicator": "first"

},

"applePayRecurringPaymentRequest": {

"paymentDescription": "Test subscription",

"regularBilling": {

"label": "Subscription",

"amount": "20.00",

"type": "final",

"paymentTiming": "recurring",

"recurringPaymentStartDate": "2025-01-07T00:00:00",

"recurringPaymentIntervalUnit": "month",

"recurringPaymentIntervalCount": 1,

"recurringPaymentEndDate": "2026-01-01T00:00:00"

},

"managementURL": "https://worldline.com"

}

}

},

"hostedCheckoutSpecificInput": {

"isRecurring": true

},

"order": {

"amountOfMoney": {

"amount": 10,

"currencyCode": "EUR"

}

}

}

Recurring with trial billing :

{

"mobilePaymentMethodSpecificInput": {

"paymentProduct302SpecificInput": {

"recurring": {

"recurringPaymentSequenceIndicator": "first"

},

"applePayRecurringPaymentRequest": {

"paymentDescription": "Test subscription",

"regularBilling": {

"label": "Subscription",

"amount": "20.00",

"type": "final",

"paymentTiming": "recurring",

"recurringPaymentStartDate": "2025-04-07T00:00:00",

"recurringPaymentIntervalUnit": "month",

"recurringPaymentIntervalCount": 1

},

"trialBilling": {

"label": "Trial",

"amount": "10.00",

"type": "final",

"paymentTiming": "recurring",

"recurringPaymentStartDate": "2025-01-07T00:00:00",

"recurringPaymentIntervalUnit": "month",

"recurringPaymentIntervalCount": 1,

"recurringPaymentEndDate": "2025-04-07T00:00:00"

},

"managementURL": "https://worldline.com"

}

}

},

"hostedCheckoutSpecificInput": {

"isRecurring": true

},

"order": {

"amountOfMoney": {

"amount": 10,

"currencyCode": "EUR"

}

}

}

Sample E - MIT scheduled payments

{

"subsequentcardPaymentMethodSpecificInput": {

"subsequentType": "recurring"

},

"order": {

"amountOfMoney": {

"amount": 10,

"currencyCode": "EUR"

}

}

}Offering this payment method requires you to either register your Merchant ID (for Hosted Checkout Page integration mode) and/or created your Apple Pay certificates (for Mobile/Client Integration).

Register Merchant ID (Hosted Checkout Page)

Follow these steps:

- Login to the Merchant Portal. Go to Business > Payment methods > How to accept payments with Apple Pay > Hosted Checkout Page.

- Read the Apple Pay terms and conditions by clicking on the respective link. Flag "I have read and accept terms & conditions" to approve them

- Click on "Activate Apple Pay". You are ready to offer Apple Pay to your customers via Hosted Checkout Page integration mode

Mind the following:

- If you reject the Apple Pay terms & conditions, the payment method will not be available on our Hosted Checkout Page.

- Apple's terms and conditions can change. Keep yourself up to date by accessing them regularly.

Create Apple Pay certificates (Mobile/Client Integration)

For payments via Mobile/Client Integration, you need to create Apple certificates. Depending on whether you leave handling payment data decryption to us or do this by yourself, differences apply:

We handle decryption

This requires you to create certificates and upload them in the Back Office. To do so, follow these steps:

- Login to the Merchant Portal. Go to Business > Payment methods > How to accept payments with Apple Pay > Mobile SDKs and Server-to-Server

- Follow the instructions on the page to

a) Download the certificate signing request (CSR) on that page.

b) Create the Apple Pay certificate on the Apple developer portal using that CSR.

c) Upload the generated certificate via the "Upload certificate" button.

Find detailed information about how to apply this decryption mode in the “Integration” and “Process flows" chapters.

Mind the following:

- Make sure to create separate certificates for our test / production environment.

- Apple allows you to create a maximum of three certificates per Merchant ID. Mind that only one certificate per Merchant ID can be active. Use the three slots to manage expiring certificates.

- Due to this limitation, we recommend using different Merchant ID for our test / production environment.

- Apple certificates expire after two years. Make sure to timely create and upload a new one. We will notify you via e-mail as soon as a certificate is about to expire.

You handle decryption

This requires you to create certificates and upload them on your server. To do so, follow these steps:

- Contact us to set up your PAYONE account to allow handling decryption by yourself.

- Set up your Apple Developer account to allow handling Apple Pay token by yourself.

- Create the Apple Pay certificates on the Apple developer portal

a) Create a Certificate signing request

b) Create a Merchant Identity Certificate

c) Create a payment processing Certificate - Write the code for your app for data decryption.

Find detailed information about how to apply this decryption mode in the “Integration” and “Process flows" chapters.

This decryption mode requires more effort on your side, most notably

- Decrypting the Apple Pay payment token.

- Generating of public keys.

- Creating certificate signing requests (CSRs).

We recommend implementing it only if you

- Prefer handling data encryption yourself.

- Want to access the payment token before processing the actual payment.