Paypal

Intro

PayPal ist eine Wallet, die ihren Verbrauchern die Option bietet, online zu bezahlen. Die Verbraucher können ihrer Wallet Finanzmittel zuführen oder mit ihrer zuvor konfigurierten Zahlungsart bezahlen.

Unsere Plattform bietet Ihnen die Möglichkeit, ganz einfach Zahlungen mit PayPal online anzunehmen. Wenn Ihre Verbraucher sich für PayPal entscheiden, werden sie zu ihrem PayPal Konto umgeleitet, um die Bestellung und die Zahlungsart zu bestätigen. Danach wickeln wir die Transaktion über PayPal ab, und PayPal gibt uns Feedback. Sie und der Verbraucher erhalten eine Bestätigung in Echtzeit, die den Status der Zahlung enthält.

Unsere Plattform verfügt über eine der weitreichendsten Integrationen mit PayPal, die es gibt, und ist mit der Express Checkout Schnittstelle von PayPal verbunden. Als Integrationsoptionen haben Sie die Wahl zwischen Express Checkout Shortcut (ECS) und Express Checkout Mark (ECM).

PayPal is phasing out its legacy API and migrating to the PayPal Complete Payment.

To guarantee uninterrupted transaction processing and to offer PayPal’s newest features, we will upgrade our connection with PayPal accordingly in 2025.

By doing so, PayPal will support

- A simplified onboarding/activation procedure.

- Full-stack PayPal payment processing for merchants.

- Improved fraud prevention.

To offer these features to you, we will migrate your existing integration in the months to come. We will contact you in time, informing you about necessary modifications in your PayPal integration.

You can test the upgraded version already in our test environment now. To do so, follow these steps:

- Login to the Merchant Portal test environment. Go to Business > Payment methods PayPal.

- Follow the Integrated Sign Up (ISU) process to access or create a PayPal account.

- Once configured, the PayPal Platform Commerce is active, offering the features mentioned above.

Wichtigste Vorteile

- Bekämpfung von Betrug: Ermöglicht Ihnen die Verwendung von Nutzerdaten zur Betrugsbekämpfung

- Einzelposten: Erlaubt Ihnen, Basket-Artikel in die Transaktion einzubeziehen

- Direct Sale und Autorisierung/Datenerfassung

- Re-Autorisierungen

- Ungültige Autorisierungen

- Gutschriften: Vollständige/teilweise Gutschriften auf Einzelerfassung; Vollständige Gutschriften auf Mehrfacherfassungen

- Schutz des Verkäufers

Einstieg

Follow the instructions in the "Zusätzliche Informationen" chapter to activate PaypPal in your account.

Länder & Währungen

Unterstützte Länder

-

Afghanistan

Afghanistan

-

Albanien

Albanien

-

Algerien

Algerien

-

Samoa Amerikanisch

Samoa Amerikanisch

-

Andorra

Andorra

-

Angola

Angola

-

Anguilla

Anguilla

-

Antigua und Barbuda

Antigua und Barbuda

-

Argentinien

Argentinien

-

Armenien

Armenien

-

Aruba

Aruba

-

Australien

Australien

Unterstützte Währungen

- Australischer Dollar

- Brasilianischer Real

- Kanadischer Dollar

- Tschechische Krone

- Dänische Krone

- Euro

- Hongkong-Dollar

- Ungarischer Forint

- Israelischer Neuer Schekel

- Japanischer Yen

- Malaysischer Ringgit

- Mexikanischer Peso

Integration

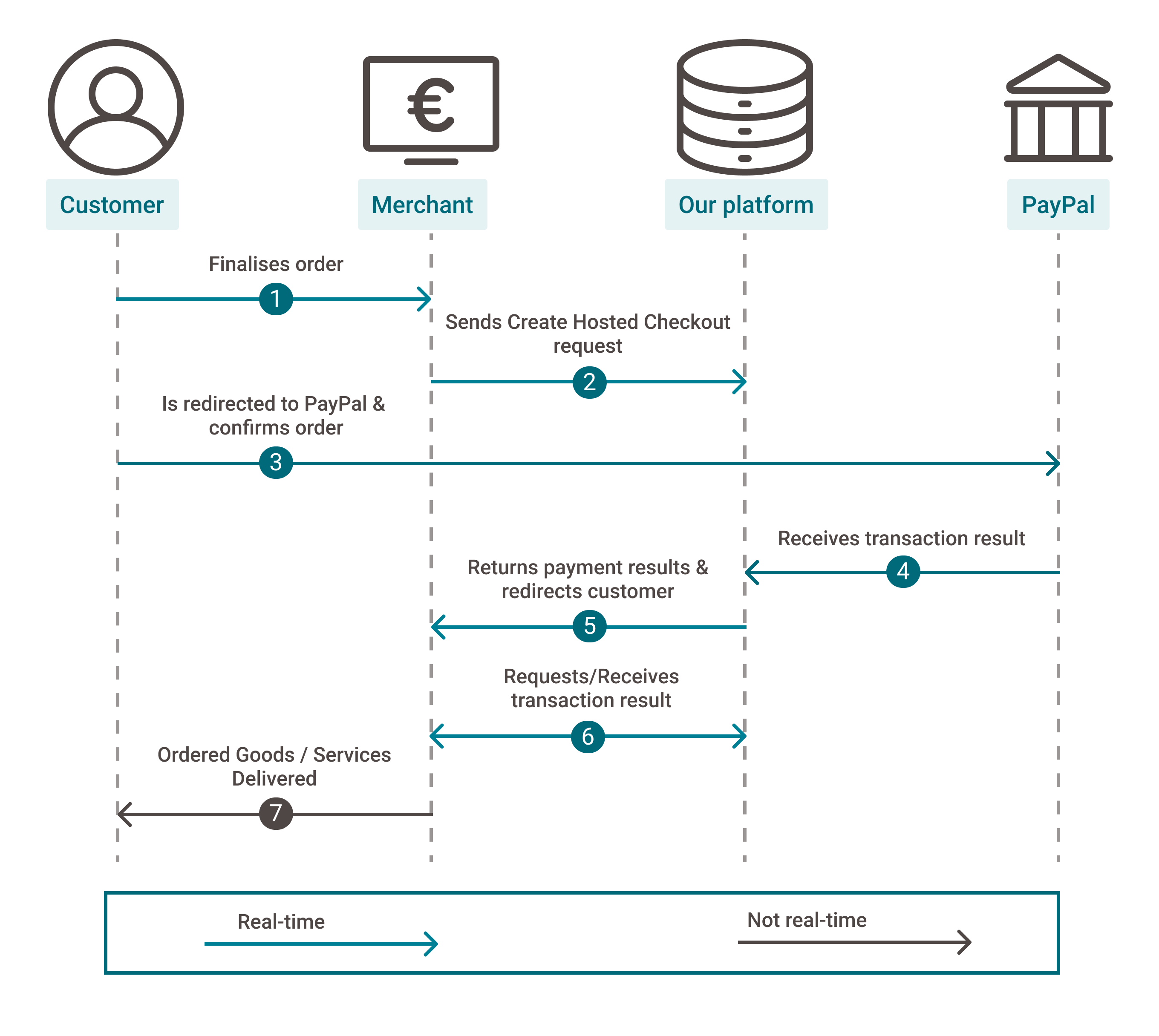

Leiten Sie Ihre Kunden zum Paypal-Portal über unsere Hosted Checkout Page weiter. Einen allgemeinen Überblick finden Sie im Kapitel "Zahlungsablauf".

Unsere Plattform erlaubt sowohl den Express Checkout Mark als auch Express Checkout Shortcut Modus. Je nach dem gewählten Modus gibt es Unterschiede:

Express Checkout Mark mode

Fügen Sie die folgenden Properties einer CreateHostedCheckout-Standardanfrage hinzu:

{

"order": {

"amountOfMoney": {

"currencyCode": "EUR",

"amount": 1000

}

},

"hostedCheckoutSpecificInput": {

"returnUrl": "https://yourReturnURL.com"

},

"redirectPaymentMethodSpecificInput": {

"paymentProduct840SpecificInput": {

"isShortcut": false

},

"PaymentProductId": "840"

}

}

Express Checkout Shortcut mode

Fügen Sie die folgenden Properties einer CreateHostedCheckout-Standardanfrage hinzu:

{

"order": {

"amountOfMoney": {

"currencyCode": "EUR",

"amount": 1000

}

},

"hostedCheckoutSpecificInput": {

"returnUrl": "https://yourReturnURL.com"

},

"redirectPaymentMethodSpecificInput": {

"paymentProduct840SpecificInput": {

"isShortcut": true

},

"PaymentProductId": "840"

}

}| Properties | Hinweise |

|---|---|

|

redirectPaymentMethodSpecificInput |

paymentProductId: Der numerische Identifikator der Zahlungsart auf unserer Plattform. Diese ID finden Sie im Kapitel "Überblick". Dieses Property weist unserer Plattform an, Ihre Kunde direkt zum Paypal-Portal weiterzuleiten. Lassen Sie dieses Property weg, leitet unsere Plattform Ihre Kunden stattdessen zu der Hosted Checkout Page um. Dies erlaubt Ihren Kunden, diese oder eine andere Zahlungsmethode zu wählen, welche in Ihrem Konto aktiv ist. requiresApproval: Auf „false“ setzen, da Sie Zahlungen über Direktverkauf verarbeiten müssen. |

|

paymentProduct840SpecificInput.isShortcut |

Legt fest, ob Sie Express Shortcut (true) oder Checkout Mark (false) nutzen. |

|

hostedCheckoutSpecificInput.returnUrl |

Die URL, an die wir Ihre Kunden weiterleiten, nachdem die Zahlung beendet ist. |

Ausführliche Informationen über dieses Objekt und seine Eigenschaften finden Sie in unserer CreateHostedCheckoutAPI

Zahlungsablauf

- Ihre Kunden geben in Ihrem Shop eine Bestellung auf und wählen PayPal.

- Sie senden eine dieser CreateHostedCheckout Anfragen (Express Checkout Mark oder Express Checkout Shortcut) an unsere Plattform.

- Sie leiten Ihre Kunden über die redirectUrl zum PayPal Portal. Sie bestätigen die Bestellung mit ihren Login-Anmeldedaten (E-Mail-Adresse und Passwort).

- Wir erhalten das Ergebnis der Transaktion.

- Wir leiten Ihren Kunden um zu Ihrer returnUrl.

- Sie fragen das Ergebnis der Transaktion via GetPayment bei unserer Plattform an oder Sie erhalten das Ergebnis via Webhooks.

- Wenn die Transaktion erfolgreich verlaufen ist, können Sie die Güter / Dienstleistungen ausliefern.

Testdaten

In unseren Testszenarios finden Sie Testdaten und detaillierte Instruktionen.

Stellen Sie sicher, den korrekten Endpunkt anzusteuern und zurück zum Live-Endpunkt zu wechseln, sobald Sie Ihre Tests abgeschlossen haben

Zusätzliche Informationen

To offer this payment method to your customers, make sure to

- Sign an acquiring contract with PayPal and activate the payment method in your PSPID. We are happy to assist you.

- Create PayPal test / live accounts and link them to our platform.

- Set up your PayPal account.

- Configure the payment method in your PSPID.

Check out the following chapters to get all set!

Create PayPal test/live accounts

Both our and PayPal's test environment offer you to test your integration before going live.

Linking your PAYONE E-Payment test account to the PayPal Sandbox with dedicated test credentials allow you to stage scenarios in a safe and realistic way. Create your test account on our platform and learn here how to set up the PayPal Sandbox for end-to-end testing.

Once you are done testing, create your live account on our platform and your PayPal live account and configure them both.

Configure Merchant Portal

To activate PayPal in your account, follow these steps:

- Login to the Merchant Portal. Go to Business > Payment methods > PayPal.

- In "How to activate PayPal", click on "Create and login to your PayPal account".

- You are redirected to the PayPal Platform. If you do not have a PayPal account yet, create one using the Integrated Sign Up (ISU). If you already have an account, login via the ISU.

- Grant PayPal permission to connect your PayPal account with our platform by clicking on the "Allow" button. Click on the "Return" button to go back to the Merchant Portal.

- Go to Business > Payment methods > PayPal. Check in "How to activate PayPal" that the "PayPal Payer ID" field has been filled in. Click on the "Activate PayPal".

The payment method will now be available on your account and to your customers.