Merchant Portal

Einführung

When processing online transactions, it’s important to keep track of your financial operations. Our Merchant Portal is an intuitive dashboard to manage your transactions.

It allows you very easily to

- Get a comprehensive picture of your transactions processed through PAYONE E-Payment

- Look up payments by various parameters (payment method, amount, currency etc.) and perform maintenance operations

- Follow-up on settlements and disputes

- Configure the API credentials for authentication and webhooks

Access Merchant Portal

Access the Merchant Portal via the login page. Depending on the environment you want to access, you have to open the respective URL:

If this is your first login, you have to set up two-factor authentication. Once you have entered your correct password, follow the instructions on the subsequent screen. You need to install a two-factor-authenticator on your mobile device, which you will use to scan the QR-code on the login screen. Your mobile device will then provide you with the one-time code.

Depending on your choice, differences apply.

Authy

- Download the app from the app store.

- Install the app by registering with your phone number and your e-mail address.

- Follow the app instructions to create an Authy account: You receive a confirmation code in your e-mail inbox which you enter in the mobile device.

- Scan the QR code on our login page.

- You receive the one-time code. Enter it in the "One-time code" field on our login page.

5'(optional). Enter a "Device name" for your mobile device you use for two-factor authentication.

Google authenticator

- Download and install the app.

- Scan the QR code on our login page to add your Merchant Portal account to the app.

- Enter the one-time code from the app in the "One-time code" field on our login page.

3'(optional). Enter a "Device name" for your mobile device you use for two-factor authentication.

Microsoft authenticator

- Download and install the app.

- Choose the option "Scan QR code" in the app.

- Scan the QR code on our login page.

- Enter the one-time code from the app in the "One-time code" field on our login page.

4'(optional). Enter a "Device name" for your mobile device you use for two-factor authentication.

Once you have logged in, you have access to the following tabs via the side menu:

If you have lost your password, reset it by following the instructions in our dedicated guide.

Understand Dashboard tab

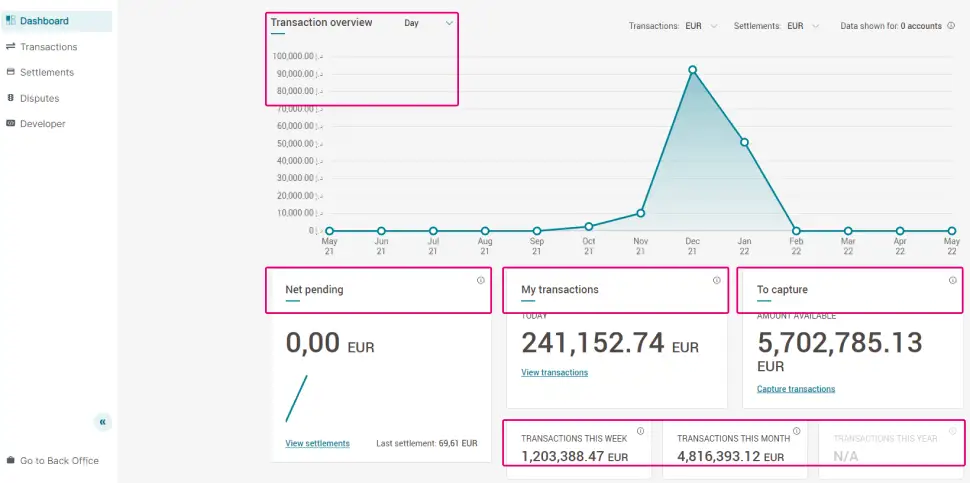

The "Dashboard" tab provides you a condensed overview on your cash flow, with links to other tabs for quick actions.

| Module | Description/Possible actions |

|---|---|

| Transaction overview |

A graphical representation of incoming transactions per

|

| Net pending |

Funds linked to the next settlement to be paid out. This amount is subject to changes depending on new transactions processed, refunds, chargebacks etc. Click on "View settlements" to go to the "Accounting" tab for a detailed overview. |

| My transactions |

Combined value of today’s processed transactions, regardless of the transaction status. Hence, this sum also includes unsuccessful transactions (statusOutput.statusCode=0/1/2 etc.), authorisations (statusOutput.statusCode=5) and refunds/cancellations (statusOutput.statusCode=6/7/8 etc.). Click on "View transactions" to go to the "Transactions" tab for a detailed overview. |

| To capture |

Combined value of all transactions in statusOutput.statusCode=5 you still have to capture. |

| Transaction this week Transactions this month Transactions this year |

Combined value of all transactions within the respective period in the respective currency. |

Understand Transactions tab

Here you can filter your processed transactions by one or more of the following parameters. This allows you to quickly look up transaction(s) and/or perform actions (i.e. captures, refunds) on them, even on transaction bulks.

Look up transactions

| Parameter | Description |

|---|---|

| From...to... |

Select a time period up of up to 18 months. The transaction’s timestamp refers to the date/time when it was authorised (statusOutput.statusCode=5 or 9 for direct sales / Status="Authorized" or "Payment requested" for direct sales). For unsuccessful transactions (i.e. statusOutput.statusCode=0 or 1 / Status="Invalid or incomplete" or "Cancelled by customer", the timestamp refers to the moment you request reached our platform/your customers cancelled the transaction. |

| Merchant reference |

Your identifier for the order (The value you sent in property order.references.merchantReference). Also accepts wildcard characters. To look up i.e. "abc-123", enter "%-123". |

| Payment method | The payment method the transactions were processed with. The content of the drop down menu is identical to your active payment methods. |

| Amount | Value you sent in property order.amountOfMoney.amount. |

| Status | The human-readable, string-based global transaction status description. Find a complete overview of all possible statuses in our dedicated guide, including a mapping for the numeric property statusOutput.statusCode . |

Learn more about the global transaction status and individual maintenance operations in chapter "Understand transaction overview".

Once you have applied you filter, you can access detailed information for any transaction by clicking on the "Merchant reference".

Understand transaction overview

Find here a detailed overview of individual transactions and the possibility to perform maintenance operations on them.

By clicking on the "Action" drop down button and filling in the amount field, you can perform (partial) captures, refunds and authorisation cancellations. If you want to perform the same action to more than one transaction, learn how to do this in the “Perform bulk actions“ chapter.

The fields displayed in the overview contains valuable information about the overall status and the transaction’s history. Some of them are self-explanatory, but some require a deeper understanding to get a full picture:

| Parameter | Description |

|---|---|

| Merchant reference | Your identifier for the order (The value you sent in property order.references.merchantReference). |

| Payment ID | A unique technical reference number our platform automatically generates for each transaction. |

| Authorization Date | The timestamp the transaction reached status (statusOutput.statusCode=2/5/9). |

| Fraud score | Our Betrugserkennung Module’s risk assessment. |

| Status | The human-readable, string-based global transaction status description. Find a complete overview of all possible statuses in our dedicated guide, including a mapping for human-readable, string-based status and the numeric propertystatusOutput.statusCode. |

| History |

Provides a list of individual maintenance operations (i.e. authorisations/captures/refunds) you have performed on the transaction, either via the Merchant Portal or the PAYONE E-Payment API. Each maintenance operation shows individual data of

|

Learn more about the global transaction status and individual maintenance operations in a dedicated chapter in our Webhooks guide.

Perform bulk actions

If you want to perform maintenance operations on a bulk of transactions at once, the Merchant Portal allows you to do so easily by following these steps:

- In the Transactions tab, flag individual transactions for which you want to perform the same maintenance operation. You can apply filter “Status” or any other parameter to help you filter out transactions.

- From the drop down menu "Bulk actions", select one of the following actions:

a) "Capture amounts": Capture statusOutput.statusCode=5 transactions to turn them intostatusOutput.statusCode=9 .

b) "Refund amounts": Refund statusOutput.statusCode=9 transactions to turn them into statusOutput.statusCode=8 .

c) "Cancel authorizations": Cancel the authorised amount for statusOutput.statusCode=5 transactions to turn them into statusOutput.statusCode=6.

Find a complete overview of all possible statuses in our dedicated guide.

Understand Create payments tab

This tab contains our code-free solutions for processing transactions.

Understand Payment requests

Find here a detailed overview of individual transactions you have processed using our Pay-by-link feature. Read our dedicated chapter to learn more.

Understand Generate link feature

Create a payment link you can share with your customers with just a few links. Read our dedicated guide to learn more.

Understand e-Terminal feature

Accept payments effortlessly for card-not-present situations using the e-Terminal module. Read our dedicated guide to learn more..

Understand Accounting tab

Processing online transactions can be challenging. Apart from solving the technical aspect, you also want to keep track of your income and spending generated by your transactions.

This tab gives you maximum transparency of what you earn and what you pay for processed transactions either via Full Service or any of your external acquirers. Make sure to select either "Collect" for Full Service or "External acquirers" respectively before you consult the available data.

Understand Net pending

All income / cost counted up to final sum in the respective currency pending to be paid out. Negative figures indicate that the incoming transaction flow (the gross amount) do not cover your costs (fees, refunds, chargebacks)

Understand Settlements history

Each line in the table represents a batch of transactions your acquirer has processed for one settlement. Use one or more of the following parameters to look up individual settlements:

| Parameter | Description |

|---|---|

| From...to... | Select a time period up of up to 18 months. |

| Acquirer | The acquirer processing the settlement. Fixed value "Collect" for transactions process via Full Service. |

| Amount | Net amount you receive after deducting all costs for this settlement. Learn more about this in the "Understand Reporting" chapter. |

| No. of transactions | Amount of transactions included in this settlement. |

| Action | Download all settlement reports from the current table as one file or individually by clicking on “Download report” in the respective line. Learn more about reports in the "Understand Reporting" chapter. |

Understand Reporting

The Merchant Portal provides downloadable reports breaking down transactions earnings and costs. Every report from the "Settlements history" table contains the following data in .csv format:

| Column | Description |

|---|---|

| Merchant | The PSPID on our platform you have sent the transaction to for processing. |

| Channel | The channel used to process the transaction. |

| Transaction Id |

Unique transaction reference in our system in format id/operations.id (properties id/operation.id received from a GetPaymentDetails request). Learn more about this reference and these properties in a dedicated chapter in our Webhooks guide. |

| Operation |

Beneficiary for the funds related to the transaction. Possible values:

At the end of each file this column breaks down all costs resulting in the net amount:

|

| Merchant Ref | Your unique reference as sent in property order.references.merchantReference. |

| Order Description | Your additional reference as sent in property order.references.descriptor . |

| Order Date | Time stamp the transaction request was sent to our platform. |

| Payment Date | Time stamp the transaction was settled by the acquirer. |

| Gross Amount | Gross amount of the transaction as sent in property order.amountOfMoney.amount. |

| Gross Amount Currency | Gross amount's currency as sent in property order.amountOfMoney.currencyCode. |

| Interchange Fee | Interchange fee deducted from this transaction from the gross amount. |

| Interchange Fee Currency | Interchange fee ISO currency code. |

| Scheme Fee Total | Scheme fee deducted from this transaction from the gross amount. |

| Scheme Fee Total Currency | Scheme fee ISO currency code. |

| Commission | Acquirer/collector commission. |

| Commission Currency | Acquirer/collector commission ISO currency code. |

| Net Amount |

Net amount to be paid out to you for this transaction: gross amount minus costs/fees as defined in columns:

|

| Net Amount Currency | Net amount ISO currency code. |

| Reserve Debit Amount | Fees we charge for processing all the transactions. |

| Reserve Debit Currency | Reserve Debit Amount ISO currency code. |

| Fx Rate | Exchange rate for converting any transaction currency (as sent in property order.amountOfMoney.currencyCode) to your settlement currency. |

| Fx Fee | Exchange rate fee deducted from this transaction. |

| Fx Fee Currency | Fx Fee ISO currency code. |

| Status |

Reconciliation status for this transaction. Depending on the transaction’s status, the following values apply:

|

| Payment Method | Payment method / brand used for this transaction. |

| Payout Ref | The acquirer's unique reference for this settlement. |

| Payout Date | Settlement date in format Month/Day/Year. |

| Payout Account | Bank account to which the amount linked to this settlement has been paid. |

Understand Disputes tab

This tab allows you to follow-up on ongoing and past disputes related to fraudulent transactions.

Read our dedicated Umgehen mit finanziellen Streitfällen guide to learn more about:

- The dispute process in general.

- Different dispute scenarios.

- The help we offer dealing with them.

- Necessary actions from your side for any dispute scenario.

Understand "Total amount to challenge" table

This table sums up all outstanding funds related to unresolved cases that you can still defend. Make sure to follow the established process for the applicable dispute scenario.

Understand "Chargeback rates" tables

Chargeback rates indicates the percentage of disputed funds in relation to the gross/net transaction amounts. The higher the rate, the more likely you will be subject to a card scheme monitoring program.

Make sure to follow our best practices to avoid fraud altogether:

Understand Disputes table

The "Disputes" table provides an overview about pending, ongoing and past dispute cases. Use one or more of the following parameters to filter your disputes:

| Parameter | Description |

|---|---|

| Merchant reference | Your identifier for the order (The value you sent in property order.references.merchantReference) related to this dispute. |

| Customer name | The card/bank account owner linked to this disputed transaction. |

| Dispute |

Disputes categorised by their treatment status. Possible values:

|

| Amount | Amount linked to this dispute. |

| 3DS |

The result of the 3-D Secure authentication check linked to this transaction. Possible values:

|

Learn more about authentication results and liability shifts in our dedicated 3-D Secure and SCA guide.

Understand Developer tab

Configure your account to link your webshop/ordering system to our platform via one of our integration methods. This is the basis for working with our e-Terminal module, SDKs or plugins.

Understand Payment API feature

One of the requirements to process transactions is the configuration of authentication credentials. Learn in our dedicated Authentifizierung guide how to configure them.

Understand Webhooks feature

Webhooks allow our platform to automatically update your transactions’ status in your webshop/ordering system. Learn in our dedicated Webhooks guide how to do this.

Understand Branding feature

If you are using our Hosted Checkout Page, you redirect your customers to our secure payment page during the payment flow. To smooth out the transition, you can customise the look and feel of this secure payment page. Follow the instructions to create a template.

However, if you are using our PayByLink solution, you can customise payment links directly in the Merchant Portal via this interface:

| Parameter | Description |

|---|---|

| Merchant name |

Your company name appearing in the header of the secure payment page. |

| Brand color |

The hexadecimal colour code of the payment button on the secure payment page. |

| Variant name | The file name of your template. Equivalent of the createHostedCheckoutRequest.hostedCheckoutSpecificInput.variant property value sent in CreateHostedCheckout requests. |

| Logo | Your company logo appearing in the header of the secure payment page. |

Understand Business Tab

Activate and manage the payment methods you want to make available to your customers. You can activate the following payment methods:

Activate and manage payment methods

To activate a payment method from the "Not Active" list, fill in the payment method-specific credentials you have received from the payment method provider. Click on "Activate". The payment method is now active and ready for transaction processing.

De-/reactivate any of your payment methods via the slide switch or update the credentials via the "Update" button.

- You can activate any available payment method in the test environment anytime by entering placeholder data.

- Contact us to (de)activate any other payment method for you in either the test/live environment.

Manage team tab

In "Manage team", you can

- Create and manage existing users

- Define their roles and access rights

in your account.

Learn in our dedicated User Manager guide how to do it.